Commercial Vehicle Sales Report December 2019

Indian commercial vehicle industry is in the midst of a turmoil related to BSVI getting implemented from 1st April 2020, increased axle loading norms, GST implementation, amended motor vehicles act, etc. Dec 19 commercial vehicle sales report suggests some signs of recovery on account of pre-buying and irresistible discount offers in the market never heard of in near past. The smaller segments like small commercial vehicles, LCV & ICV have helped the OEMs maintain sales numbers to some extent, while the bigger MHCV trucks are worst hit.

However, the MHCV segment has now started witnessing early offshoots of pre-buying, especially the large fleet owners who see significant cost saving in bulk buying of trucks now than 3-4 months down the line when the prices are set to increase by 10-20% roughly. While on one side the discount on heavy trucks has reached an all time high, especially the 55 tonner articulated tractors like Tata 5523, Ashok Leyland 5523, Mahindra Blazo 55 & BharatBenz 5528T, there is an additional price advantage in terms of buying now than in BSVI era, when the prices are set of increase significantly.

Tata Motors Commercial Vehicles Sales Dec 19

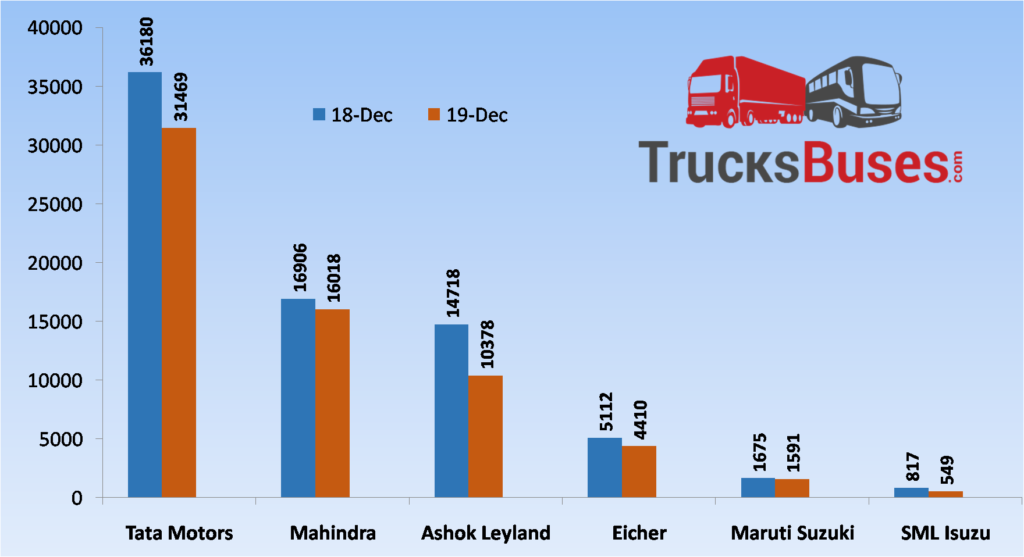

Tata Motors’ domestic Commercial vehicles sales stood at 31,469 units in December 2019, registering a drop of 13% as against the same period last year which was 36,180. Being the largest Commercial Vehicle manufacturer in India, it felt the heaviest set back also and specifically in MHCV Tata trucks segment which went down 40% in Dec 2019 at 6957 units compared to Dec 2018. SCV & Pickups showed some recovery and went up 3%, selling 562 more units than Dec 18.

Commercial Vehicles Sales Dec 19 vs Dec 18

Ashok Leyland Sales Figures Dec 19

Ashok Leyland also couldn’t save itself from the poor consumer sentiments with overall sales falling to 10,378 units in Dec 2019 from 14,718 units in Dec 2018, a 29% decline. Looking specifically at MHCV trucks segment, it registered 40% decline, selling only 6369 units this Dec 2019, which is 4252 units less than Dec 2018 sales figures.

Mahindra Commercial Vehicles Sales Figures Dec 19

Mahindra & Mahindra’s CV vertical fared the best. Its HCV portfolio consisting of Blazo range of Trucks, Tippers & Tractors, suffered the most this year with a negative yield of 42% and sold 478 units in Dec 2019 as compared to 824 units in the last corresponding period.

Eicher Trucks & Buses Sales Figures Dec 19

Volvo Eicher Commercial Vehicles registered a decline of 13.7% and sold 4410 units for the Dec 2019, compared to 5112 units sold in Dec 2018. Volvo Trucks India witnessed a growth of 7.3% as sales jumped from 123 units to 132 units.

Maruti Suzuki LCV Sales Figures Dec 19

Maruti Suzuki’s LCV division that currently has only Super Carry in its portfolio reported decline for the first time, despite an expanding dealership network.

SML Isuzu Sales Figures Dec 19

Sales of light and medium duty trucks and buses from SML Isuzu also witnessed over 30% decline to 549 units despite a very low base of 817 units in corresponding month last year. However, with the upcoming school bus season where SML Isuzu has a greater presence and customer acceptance, the sales volumes are likely to go up in the next few months.